Part of the fun of modern living is dealing with taxes. As the founder and owner of Parisian Phoenix Publishing, I handle my federal taxes with minimal angst but with the addition of Echo City Capers to our stable in 2023, we suddenly faced the reality of in-person sales where no middle man retailer would handle the 6% state sales tax.

I filed for my state sales tax license early in the summer, and mistake #1: I mistyped my email address and was only getting communication via my home email address. Then I totally misunderstood some of the numbers and identifiers the state mails you and if that weren’t enough, I totally forgot my password.

Somehow I managed to do all this damage before even fully setting up and verifying my account.

So the state locked me out of the account and told me I had to call a special number to fix it.

I did what any normal person would do. I ignored it.

I hadn’t sold any books yet anyway.

Then, the quarterly filing deadline approached. I conveniently pretended the previous errors never happened and tried to find the paperwork and file. The system remembered me and told me to call the number.

I had sold three books by this point, $10 a piece, for a whopping tax bill of $1.80. I walked away from the computer. The state tax office called me with a recorded message, once a week, while I lived in denial.

I spent the last several days giving myself a pep talk– do it, make the call, figure it out, pay the damn bill, move on with your life. If you want to make this business work you have to do these things or hire an accountant to do them. Like my abhorrence of web design, I really would love to hire an accountant and avoid this stuff.

But I cannot afford these professionals right now. So, I told myself at 10 a.m. today I would take a break from editing and call the state of Pennsylvania. I ran askew of my timeline. At 9:20, I suddenly had a minute and I thought I could, you know, get it over with.

I called.

And do you know what happened?

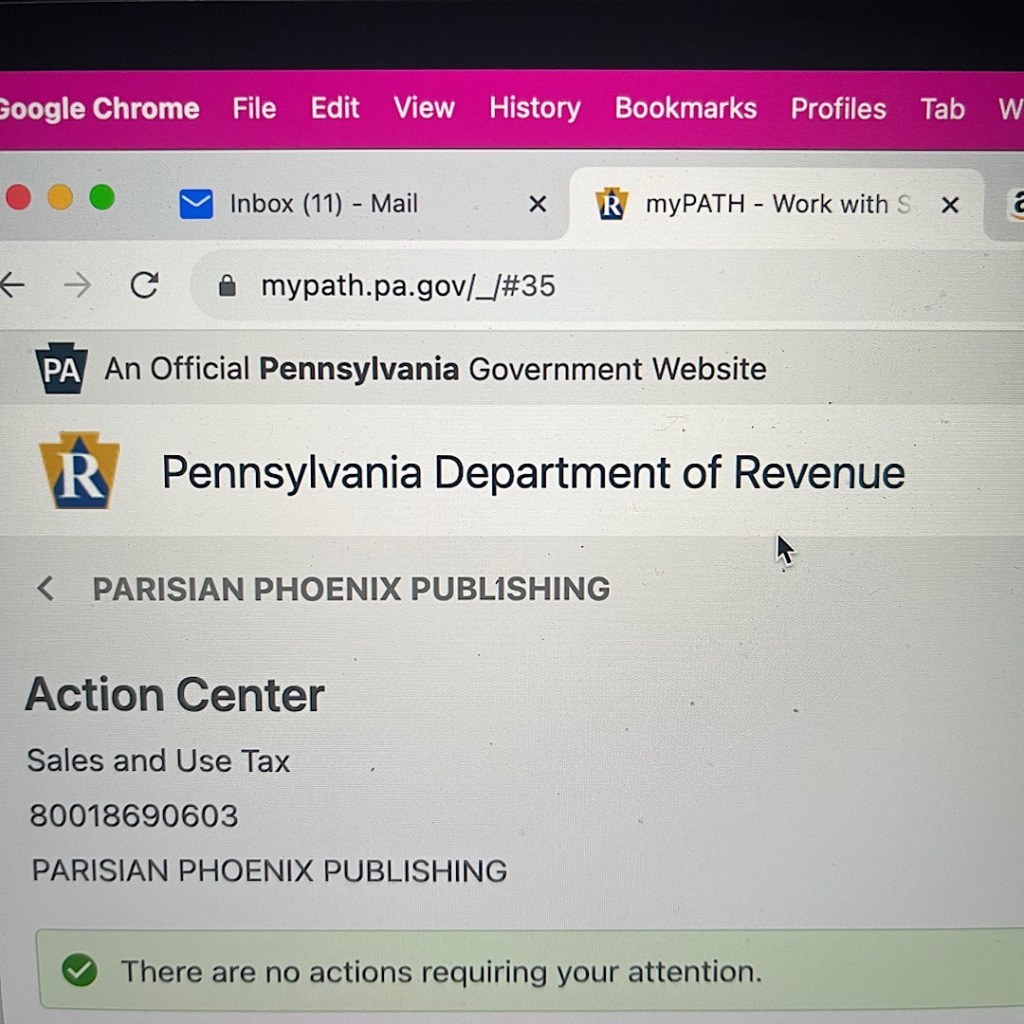

I had the nicest, most patient person on the phone. He not only helped me reset my password, but he stayed on the line with me while I verified my account, AND waited until I could see the screen where I needed to be to file my taxes.

AND THEN… he asked if I had any more questions and I said no, that it all looked straightforward from here. And that I would call back if I ran into problems again.

And he gave me one more tip… “Whatever you do,” he said. “Hit ‘file now’ and not ‘make a payment.’” Make a payment will send money in, but you need to do the paperwork first to make sure the money gets sent to the right place for the right tax. Makes sense, and seems logical, but I wrote it down anyway.

Because in the moment, when you’re stressing yourself out for no real reason, one might not be able to see the sense and the logic.

I did as he said, paid my third quarter sales tax bill and then saw several more little red buttons that suggested I had more to do. Apparently, since I registered the account in 2023, I have to back-file all the quarters paperwork. Done and done.

It’s now 10:10 a.m. and I can not only cross “Call about taxes” off my list, but I can also relax now that I’ve filed and paid them.

Leave a comment